does square cash app report to irs

Cash App Support Tax Reporting for Cash App. The IRS requires Payment Settlement Entities such as Square to report the payment volume received by US.

Edgar Filing Documents For 0001213900 20 028179

What Does Cash App Report to the IRS.

. Square account so far good info on cash payments that is not be going on square does report cash to sales irs. Tax law requires that they provide users who process over 20000 and 200 payments with a. Starting January 1 2022 if your Cash for Business account has 600 or more in gross sales in the 2022 tax year it will qualify for a Form 1099-K and Cash App is required to report it to the.

People report the payment by filing Form 8300 Report of Cash Payments Over 10000 Received in a Trade or Business PDF. Square will report your deposits to the IRS. However laws passed in March 2021 as part of the American Rescue Plan Act state that these apps now must report any business transactions that exceed 600 in a given year.

According to Cash Apps FAQ anyone who trades Bitcoin will get a Form 1099-B which Cash App will. By Tim Fitzsimons. Cash apps like Venmo Zelle and PayPal make paying for certain expenses a breeze but a new IRS rule will require some folks to report cash app transactions to the feds.

All financial processors are required to report credit card sales volume and then issue a 1099K. Theres a lot of misinformation surrounding new IRS cash app rules that went into effect January 1 2022 and many users worry their transactions on apps like PayPal Zelle. Square does not currently report to the IRS on behalf of their sellers.

The IRS wont be cracking down on personal transactions but a new law will require cash apps like Venmo Zelle and Paypal to report aggregate business transactions of. 1 mobile payment apps like Venmo PayPal and Cash App are required to report commercial transactions totaling more than 600 per year to. Certain Cash App accounts will receive tax forms for the 2021 tax year.

Log in to your Cash App Dashboard on web to download your. With Big Cash making music every part with daily bonuses. Here are some facts about reporting these payments.

New cash app reporting rules only apply to transactions that are for goods or services. Reporting Cash App Income. I believe they would have to get a warrant or supena or court order of some sort.

A person can file Form 8300 electronically. Answer 1 of 3. Payment app providers will have to start reporting to the IRS a users business transactions if in aggregate they total 600 or more for the year.

If you receive more than 600 through cash apps you will receive a 1099-K in 2023 for transactions that occurred during the 2022 tax year. The answer is very simple. Starting January 1 2022 if your Cash for.

A business transaction is.

The Patchwork Heart Patchwork Heart Granny Square Tutorial Granny Square

The 10 Biggest Fintech Companies In America 2020

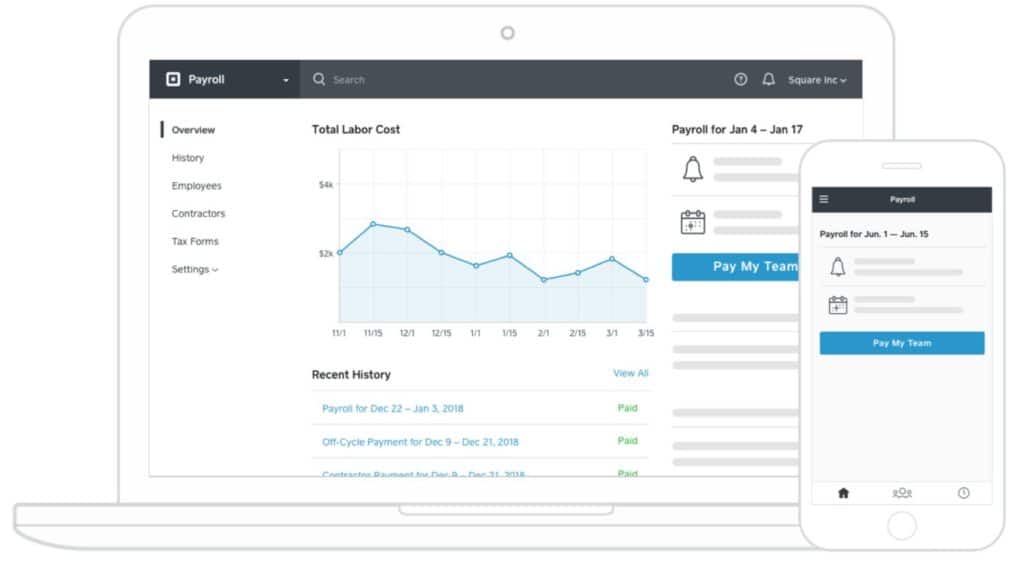

Gusto Vs Onpay Payroll Who Wins

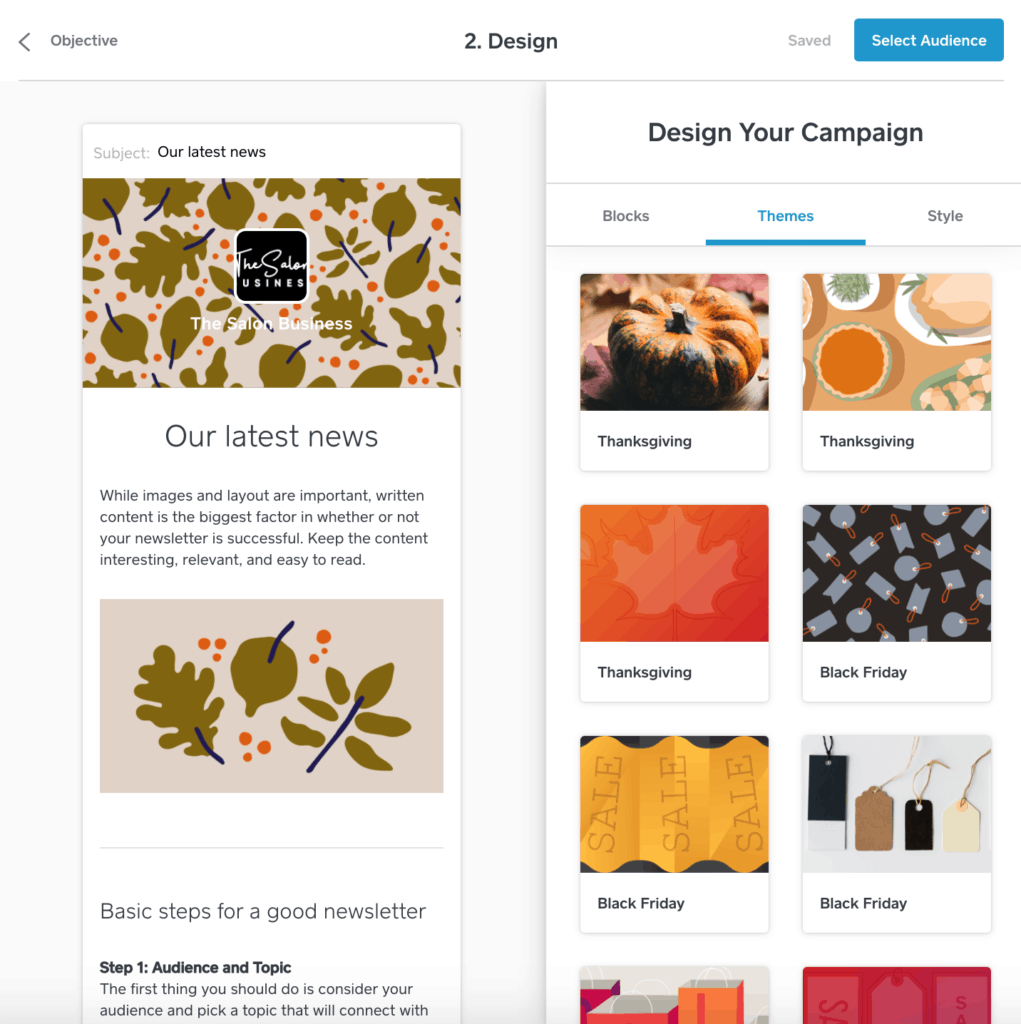

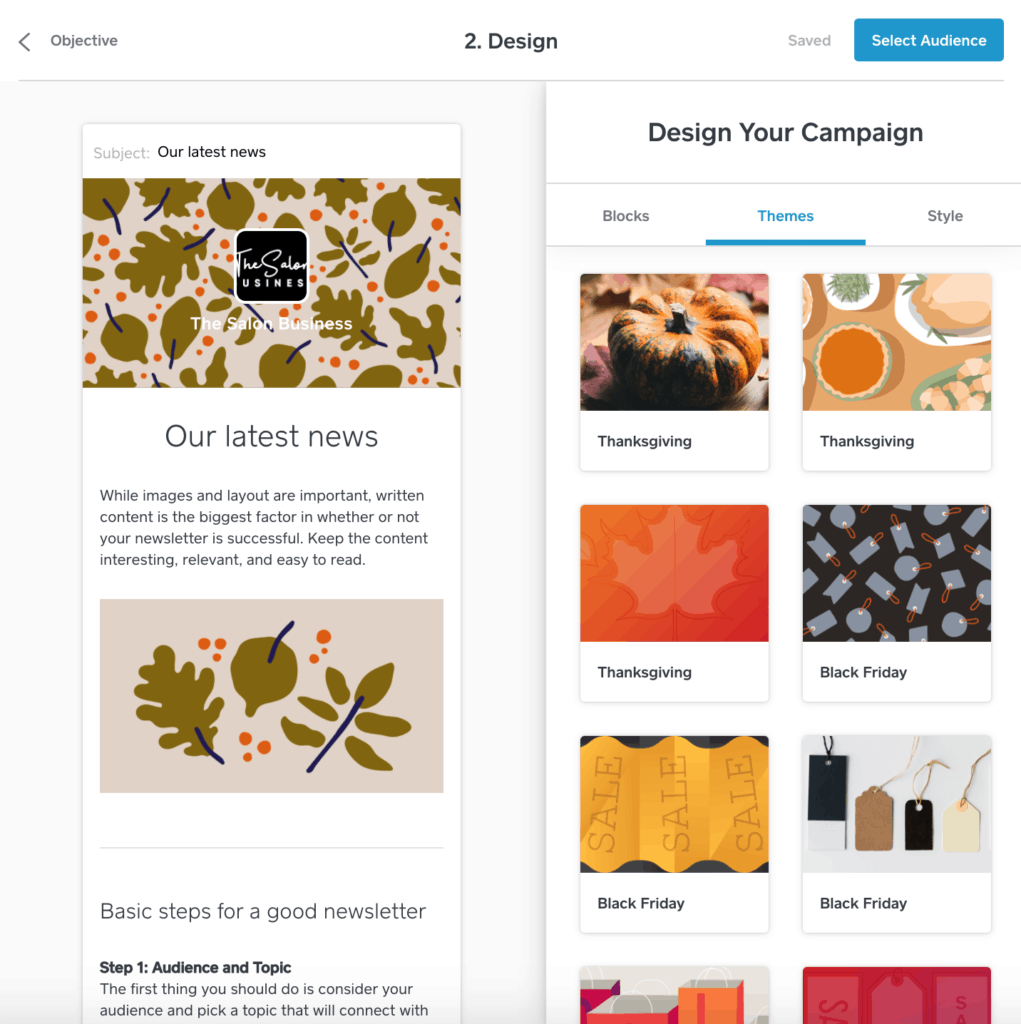

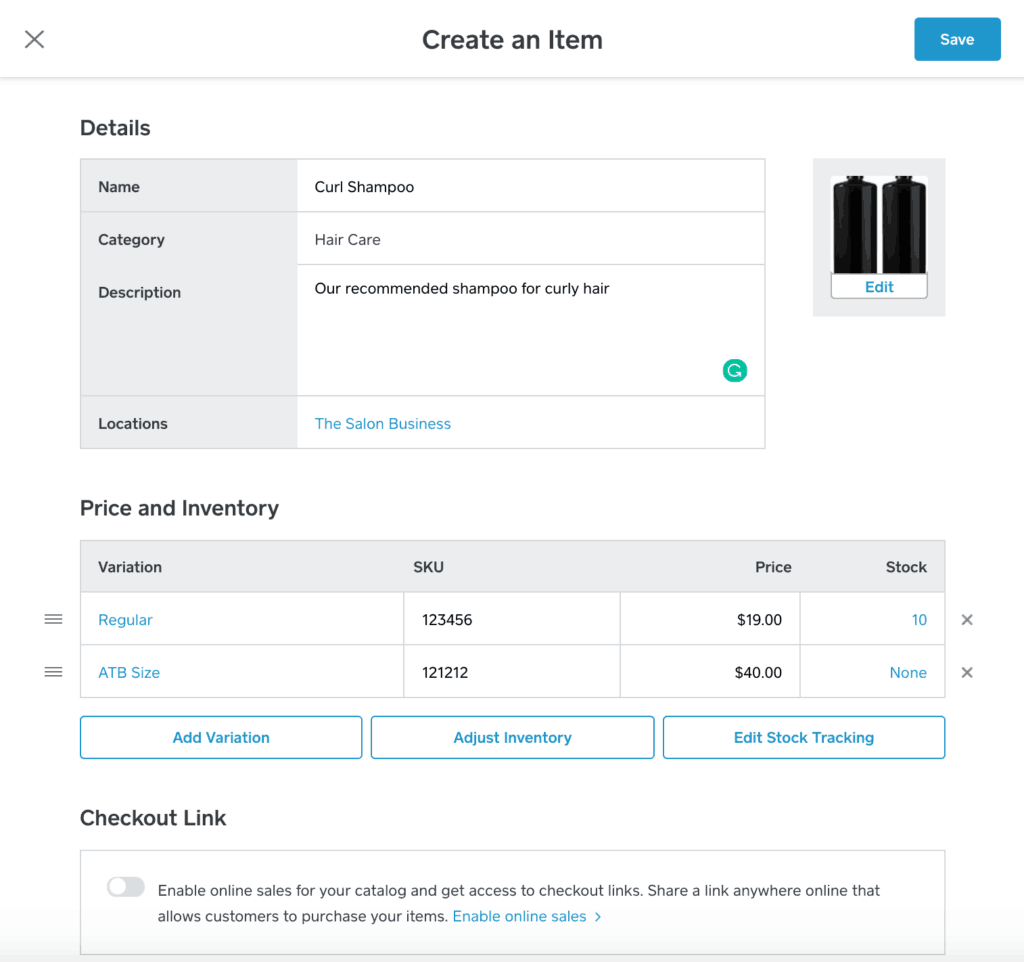

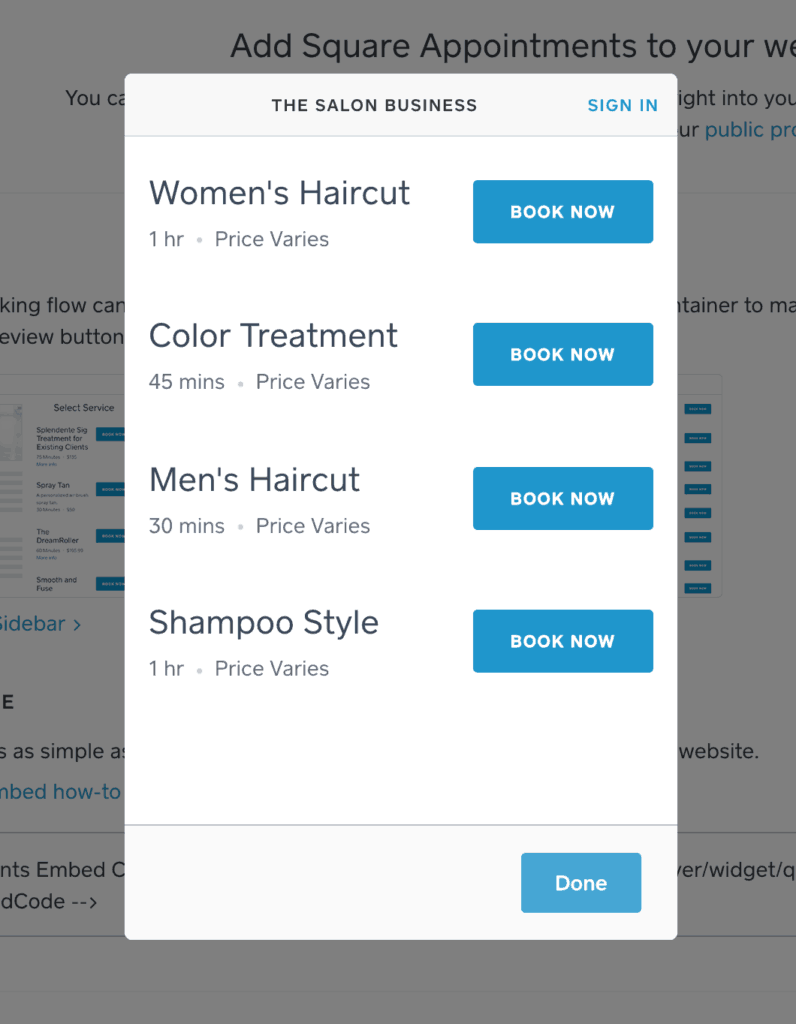

Square Appointments Vs Acuity Scheduling Review

Square Appointments Vs Acuity Scheduling Review

8 Best Paypal Alternatives For Your Small Business

Square Appointments Vs Acuity Scheduling Review

Expect Layoffs At Square Enix And Ubisoft Soon While Both Matsuda And Guillemot Wipes Their Hand Clean And Pretend That They Didn T Pivot To This Bs And Then Get Away With It

Hey Are You On Foursquare Be Sure To Check In At Uf When On Campus Https Foursquare Com V The University Of Findla University Of Findlay University Findlay

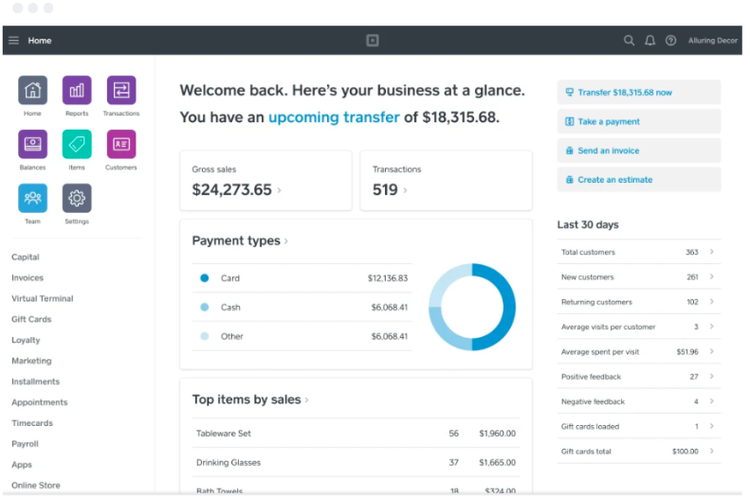

Stripe Vs Square Vs Paypal Price Features Comparison Saasant Blog

Square Appointments Vs Acuity Scheduling Review

Square Appointments Vs Acuity Scheduling Review

Does Square Work Internationally Quora

How Much Life Insurance Do I Need Nerdwallet

Square Appointments Vs Acuity Scheduling Review

Edgar Filing Documents For 0001213900 20 028179

New Tax Laws 2022 Getting Paid On Venmo Or Cash App This New Tax Rule Might Apply To You 6abc Philadelphia